6 benefits of using a Cloud accountant

6 benefits of using a Cloud accountant

If you haven’t used a cloud accountant before, you may be interested to read about some of the benefits compared to traditional accountancy. As an established digital accountancy specialist, we are passionate advocates of cloud accounting and have seen first-hand how it can revolutionise the way businesses operate. Cloud accounting is suitable for start-ups and established businesses and we make it

easy to switch from more traditional methods of managing financial information.

Easier access to information and advice

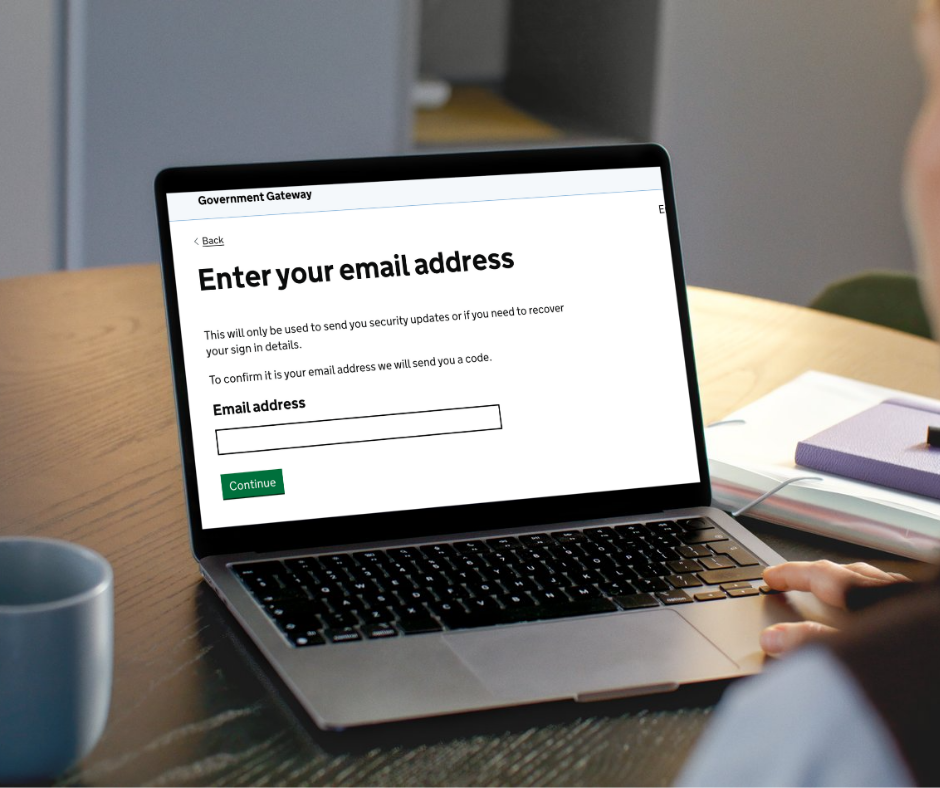

Using a cloud accountant will mean your business’s financial data and reports are stored securely on remote servers. They can be accessed by you and your accountants from anywhere. There is no longer any need to sign physical documents, request reports and updates or wait for accounts to arrive by post. This means your accountant can keep in touch with you on a more regular basis and be more proactive in the way they work with you. It also means you can see your financial status at any time, rather than waiting for an annual meeting.

Real Time Information

A cloud accountant will set up your digital accounting systems in a way that works for you and your business. They will show you how to access important information and run reports that will give you clarity in terms of cash and profitability. These systems are updated in real time which means you will always be looking at the very latest data.

Digitally savvy

Cloud accountants are comfortable with technology and can show you how to save time by using software platforms and apps to improve the way you work. Most good cloud accounting platforms like Xero integrate with bank accounts and other financial and business software, which means you can streamline a lot of your business processes. Your cloud accountant will know how these things operate and will be up to date with the very latest apps and features. This means they can also suggest specific apps and functions that will be particularly beneficial to your business.

Data security

One of the first things people ask us when we introduce the idea of cloud accounting is whether it is secure. As an established cloud accountancy firm, we have a huge amount of expertise in data security and can reassure and advise clients so that their data and practices are safe. The online platforms we use, such as Iris and Xero, have been developed with digital security in mind and as a result are much safer than most traditional data storage methods. We are proud to be Xero Gold Partners, recognising our expertise in this key financial software platform and its security features.

Flexibility and scalability

A cloud accountant will be able to help you make the best use of your accounting software as your business evolves. They will be able to set it up in a way that allows the systems and processes to be scaled and adapted to your business needs. This means that when you acquire businesses, add new services or make any kind of change to your business, the disruption to your financial management and reporting will be minimal. Cloud accountants are highly experienced in transitioning businesses through various stages of growth and development in a way that maintains consistency across their digital accounting systems. Our clients are always surprised at how little disruption is caused to their financial platforms, even when they are undergoing major transformational change.

Making informed decisions

Having real time information often inspires business decisions that might not otherwise have been considered until after year-end, when a traditional accountant would have prepared the annual accounts. In other words, running a business becomes an organic and dynamic process. This level of clarity gives business owners confidence in their numbers and clarity to forward plan. Many business owners we work with tell us that running a business has become more enjoyable because they feel in control and have greater knowledge and insight.

If you would like to know more about cloud accountancy and how it could help your business we would be happy to talk it through with you in more detail. Please give us a call on 01423 222710.

If you found these news items interesting please feel free to share with your friends, family and colleagues.