Applying for a mortgage when you’re self-employed

Applying for a mortgage when you’re self-employed

When you apply for a mortgage, the lender will want to know about your income. If you are self-employed or a company director, you need to know how to present your earnings and how they will be evaluated by the mortgage provider. Talking to us before you approach a lender can make the process smoother. Read our tips below.

How do lenders decide if someone is self-employed?

As you might expect, mortgage lenders consider anyone who is a sole trader or partner to be self-employed. However, even though HMRC regard company directors as employed, for mortgage purposes, lenders consider you to be self-employed if you have more than 25% of ordinary share capital of a limited company.

How is my income assessed by lenders?

For sole traders, income will be based on the net profit generated by their business.

If you are a director of a limited company, your income may be assessed as a combination of salary and the dividends you draw from your company. It can also be based on your company profits plus your salary, or your company's pre-tax profit, plus your salary.

How can I improve my chances of being offered a mortgage?

New paragraphLenders will want to see financial documentation and would prefer this to have been prepared by a chartered accountant.

They will be looking for a stable income and signs of a profitable business, ideally with evidence that shows a consistent income stream over two to three years.

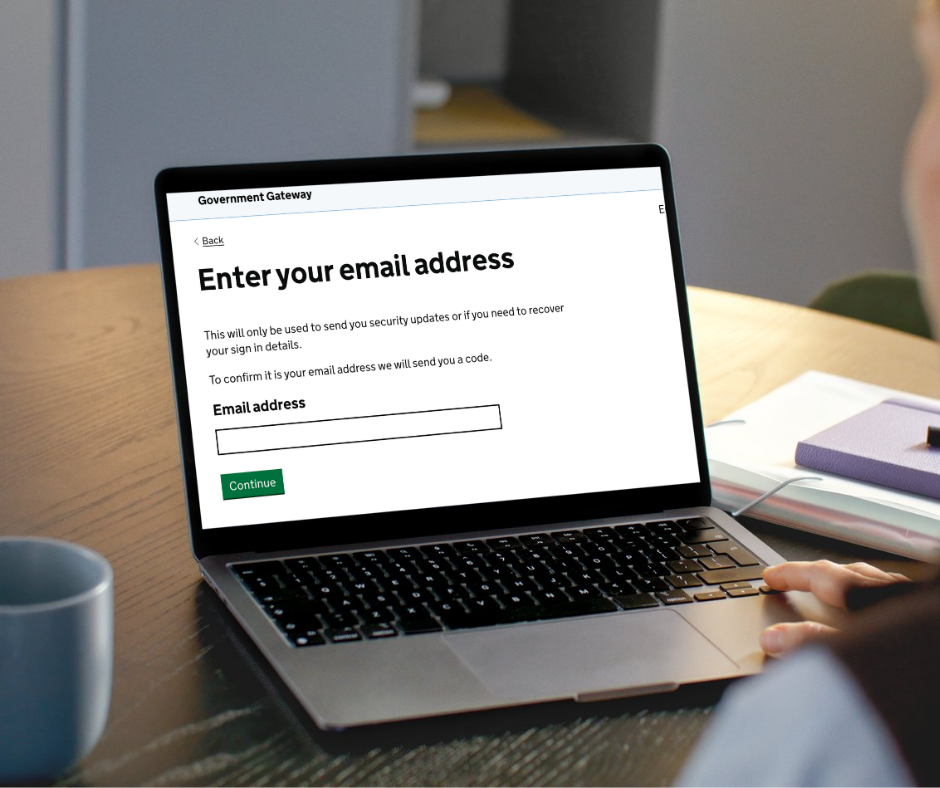

Financial documents such as SA302 forms (or our IRIS equivalent tax computation) or final company accounts will help the lender assess how reliably you will be able to repay any loan. You may also be asked to provide tax year overviews from HMRC to show that your tax account is up to date.

As well as evaluating your income, they will look at credit history and assess affordability of the amount you want to borrow by checking your other outgoing.

Checking that you meet the criteria

As we mentioned earlier, you should talk to your accountant as soon as possible if you are thinking of applying for a mortgage. We can look at your accounts and discuss your options if some of the criteria outlined above cannot be met (for example, if you don’t have three years of accounts).

If you are thinking of applying for a mortgage and you are a company director or partner, please get in touch for advice. We can also put you in touch with mortgage advisors who specialise in self-emplloyed applications. You can call us on 01423 222710 or email info@wildandcoaccountants.co.uk

If you found these news items interesting please feel free to share with your friends, family and colleagues.