What are the new rules for R&D tax claims?

What are the new rules for R&D tax claims?

Changes to the way R&D tax claims (tax relief for innovations in science and technology) are made were introduced on 1st April 2023, in an effort to make the process more rigorous. In this article we’ll explore what this means to companies making applications and whether you could be missing out on valuable tax credits for innovations that are covered by the scheme.

What is R&D tax credit and what is covered?

To claim tax credits Your company must have incurred qualifying expenditure on R&D projects.

HMRC states that R&D for tax purposes takes place when a project seeks to achieve an advance in science or technology. The advance “could have tangible consequences (such as a new or more efficient cleaning product, or a process which generates less waste) or more intangible outcomes (new knowledge or cost improvements, for example)”.

The new application process

The new rules apply to companies with accounting periods beginning on or after 1 April 2023 where:

- You are making a claim for the first time;

- You have claimed for the previous tax year but didn’t submit that claim until after the last date of the claim notification period;

- Your last claim was made more than 3 years before the last date of the claim notification.

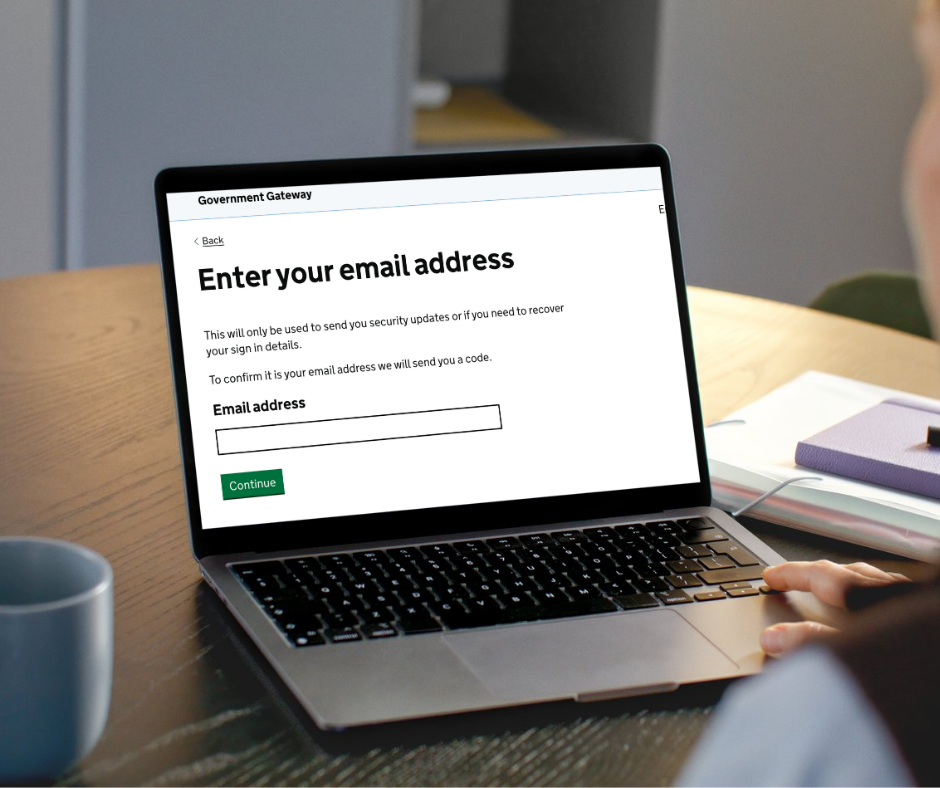

Under the new rules, R&D tax claims involve completing a claim notification form followed by an additional information form. The forms can be submitted either by a company representative, such as a director of the firm, or an adviser appointed by the business.

The latest date that companies must submit the claim notification form is 6 months after the end of the accounting period that the claim relates to. If your year end was on 31st March, therefore, the form must be submitted by 30th September. If companies fail to submit the form by this deadline, their claim will not be valid.

Claim notification form

The claim notification form will ask for contact details of those involved in submitting the application, the company’s Unique Taxpayer Reference (UTR), the accounting period for which you are applying for tax credit and a summary of activity to show that the project meets the criteria for R&D.

Additional Information form

The second form, the additional information form, must be submitted before you submit your company’s Corporation Tax Return. If you don’t do this, HMRC may remove the claim from your tax return. It is also important to make sure that the dates and information on all forms, including your tax return, are the same.

The additional information form will ask for:

- Full details of the qualifying expenditure you are claiming tax relief on as an SME, or expenditure credit as a large company or SME.

- The number of all the projects that you’re claiming for in the accounting period and their details.

The information you give will depend on the number of projects being applied for:

- Up to 3 projects - describe all the projects that cover 100% of the qualifying expenditure.

- 4 to 10 projects - describe the projects that account for at least 50% of the total expenditure, with a minimum of 3 projects described.

- Over 10 projects - describe those projects that account for at least 50% of the total expenditure, with a minimum of 3 projects described (if the qualifying expenditure is split across multiple smaller projects, describe the 10 largest).

Guidance has been issued by HMRC which explains the level of detail they require when describing projects. We recommend studying this carefully to ensure your claim is not rejected.

All R&D claims are processed electronically, and the application will be far smoother if both your business and your accountant have embraced digital accounting practices.

We are here to help you identify R&D tax credit opportunities in your business and complete your application in line with the new rules. You can call us on 01423 222710 or email info@wildandcoaccountants.co.uk

New paragraph

If you found these news items interesting please feel free to share with your friends, family and colleagues.