Capital Gains Tax on Residential Property

This is a subtitle for your new post

If you are selling a residential property that is not your main home, don’t forget to mention it to your accountant so that you are fully informed of any Capital Gains Tax implications and payment deadlines.

The 60 day CGT rule

There is now a requirement to report and pay any taxable gain within 60 days of completion of the sale of a residential property that is liable for CGT.

This applies to qualifying UK residential properties and has been effective on properties sold on or after 27 October 2021. The CGT must be reported to HMRC and paid within the 60 days. Failure to do so could result in penalties and interest charges.

Previously, CGT was reported via an annual Self Assessment Tax Return and many property owners and legal advisers are still unaware that the rules have changed. This has resulted in sellers unwittingly facing penalties from HMRC.

The requirement to declare the sale via annual tax return has not been removed, however. It is now necessary to do both. The seller will have to submit a Self Assessment Tax Return for the year in which the sale occurred. Effectively, the initial payment within 60 days of completion is a payment on account and the subsequent Self Assessment Tax Return ensures the correct amount of tax has been paid in the tax year.

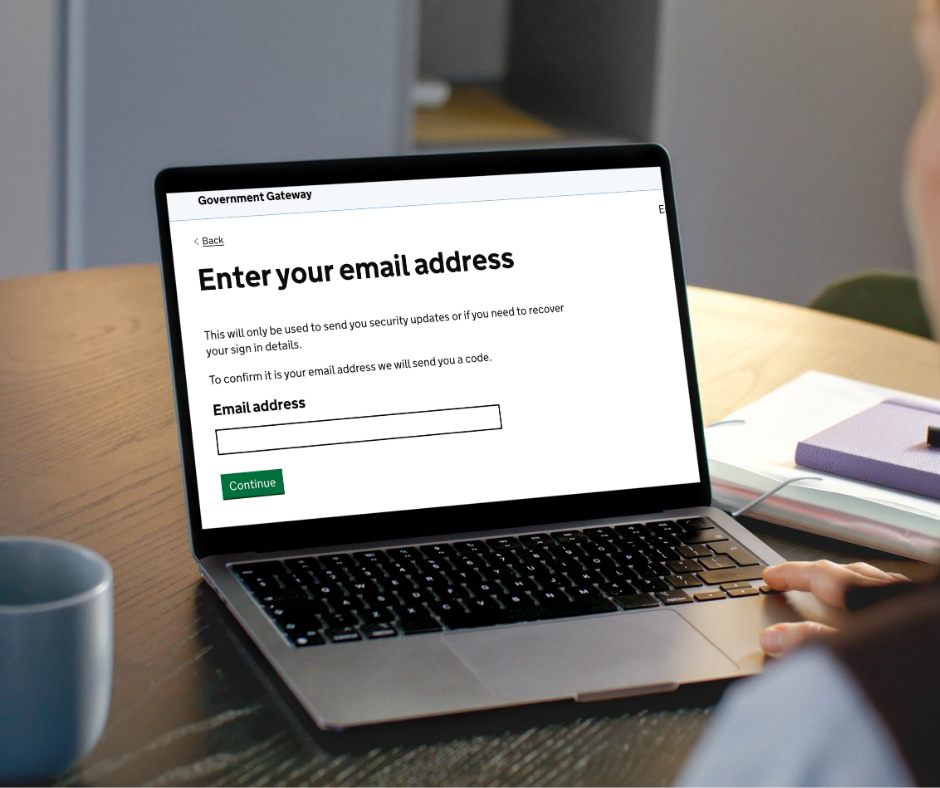

Calculating Capital Gains Tax, reporting liabilities and claiming reliefs is a complex area that has been made all the more onerous thanks to the 60 day rule. Reporting must be done through HMRC’s online portal.

At Wild & Co, we have significant experience in property taxation. We would urge our clients to keep us up to date with any potential property transactions, even if these involve residential rather than commercial property. We can advise you on calculating your capital gains tax liability and filing your tax return.

Contact Wild & Co on 01423 222710 or email info@wildandcoaccountants.co.uk for property accountancy advice and help with residential property CGT.

If you found these news items interesting please feel free to share with your friends, family and colleagues.